Orthodontics Market Size Forecast to Reach USD 65.13 Billion by 2034

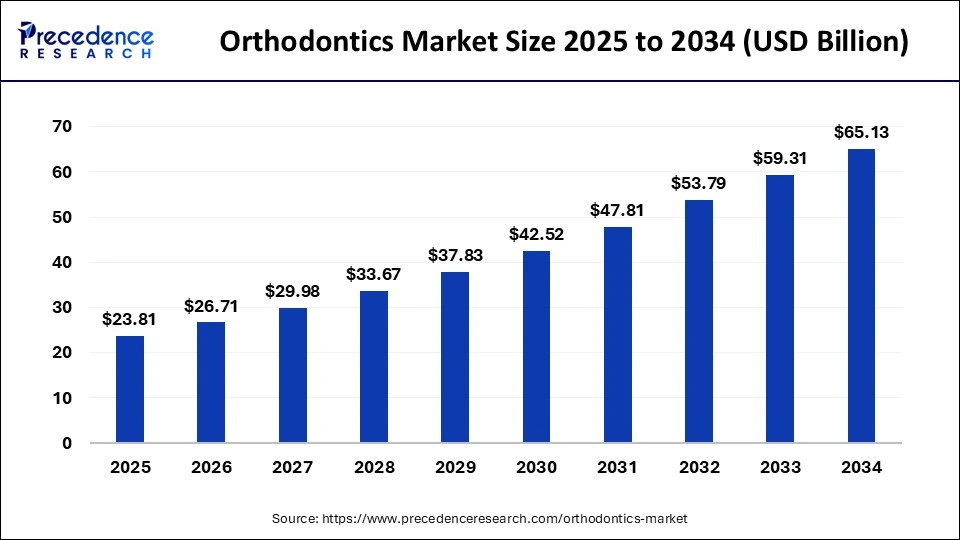

The global orthodontics market size is forecast to reach approximately USD 65.13 billion by 2034, increasing from USD 23.81 billion in 2025, and is expected to grow at a solid CAGR of 11.9% from 2025 to 2034. The orthodontics industry is undergoing a digital and aesthetic transformation. Fueled by AI-assisted diagnostics, rising adult demand for invisible aligners, and increased access to care in emerging markets, the sector is entering a decade of double-digit growth

Ottawa, July 31, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the orthodontics market size was valued at USD 21.23 billion in 2024. It is expected to be worth USD 65.13 billion by 2034. The growing popularity of cosmetic dentistry and rising awareness about the benefits of dental health drive the market growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1493

Orthodontics Market – Key Takeaways:

- The global orthodontics market size was estimated at USD 21.23 billion in 2024.

- The market is projected to hit USD 65.13 billion by 2034.

- It is expected to expand at a double-digit CAGR of 11.9% from 2025 to 2034.

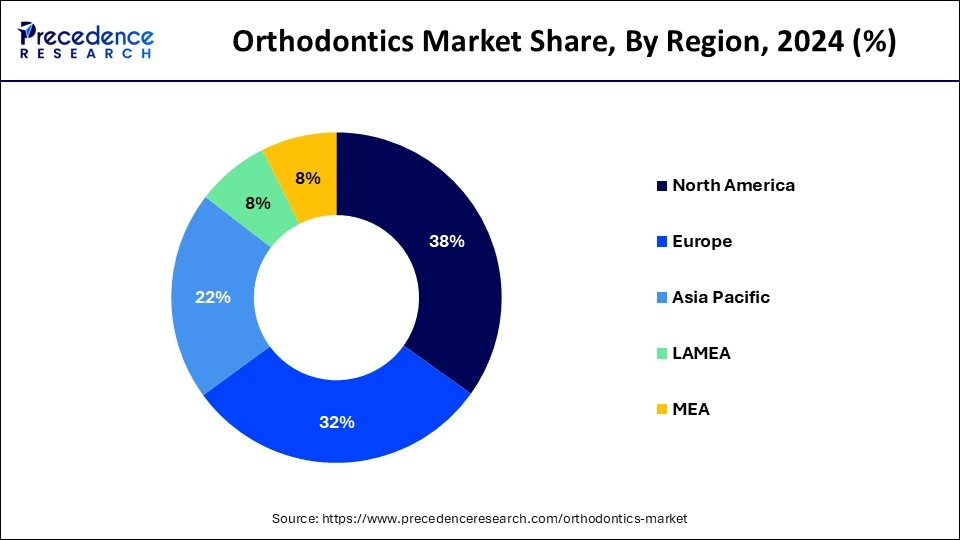

- North America accounted for the largest market share of 37.66% in 2024.

- Europe is projected to grow significantly during the forecast period from 2025 to 2034.

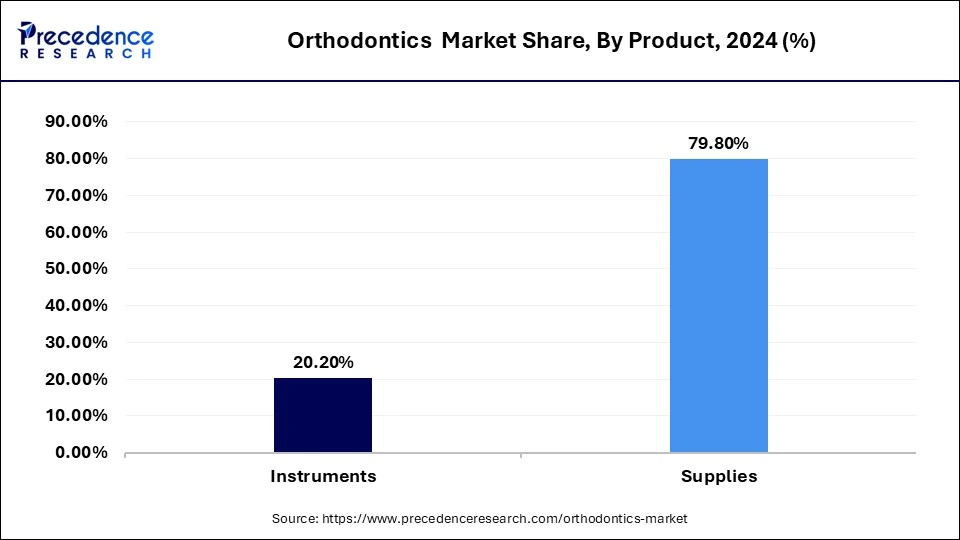

- By product, the supplies segment has held the major market share of 79.80% in 2024.

- By product, the instruments segment is expected to witness notable growth between 2025 and 2034.

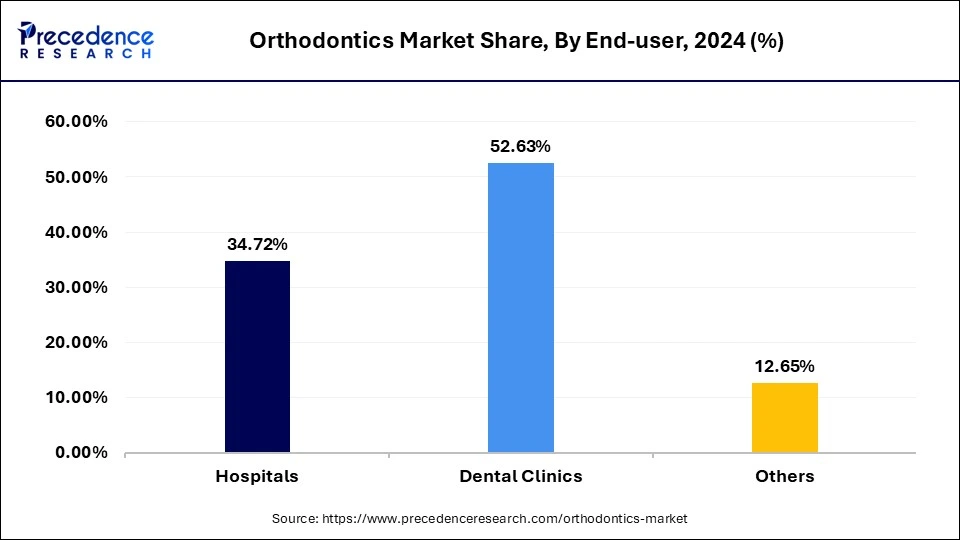

- By end user, the dental clinics segment generated the biggest market share of 52.63% in 2024.

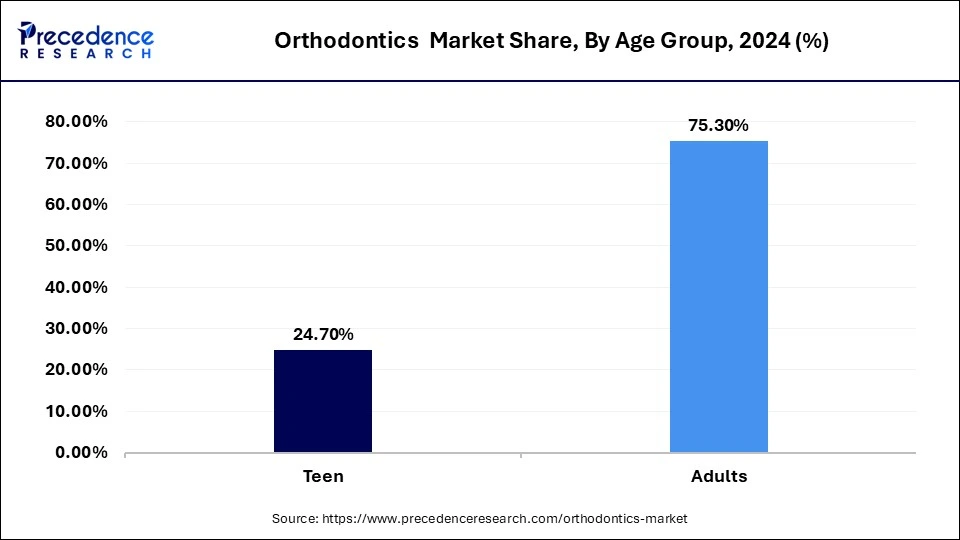

- By age group, the adults age group segment contributed the highest market share of 75.30% in 2024.

- By age group, the children age group segment is growing at a considerable from 2025 to 2034.

“With growing demand for customized dental aesthetics and technology-driven workflows, orthodontics is becoming a focal point of innovation in the broader dental care industry,” said Deepa Pandey, Principal Consultant at Precedence Research.

Orthodontics Market Revenue Analysis by Regions and Segments from 2022 to 2024

Orthodontics Market Revenue (USD Million) By Regions, 2022-2024

| Regions | 2022 | 2023 | 2024 |

| North America | 6,383.83 | 7,131.56 | 7,970.38 |

| Europe | 3,733.06 | 4,191.23 | 4,707.70 |

| Asia Pacific | 5,462.47 | 6,151.26 | 6,929.93 |

| LAMEA | 1,321.43 | 1,463.15 | 1,620.27 |

Orthodontics Market Revenue (USD Million) By Product, 2022-2024

| Product | 2022 | 2023 | 2024 |

| Instruments | 3,397.08 | 3,815.92 | 4,288.27 |

| Supplies | 13,503.72 | 15,121.28 | 16,940.01 |

Orthodontics Market Revenue (USD Million) By End User, 2022-2024

| End User | 2022 | 2023 | 2024 |

| Hospital | 5,891.64 | 6,588.33 | 7,370.64 |

| Dental Clinics | 8,841.23 | 9,936.23 | 11,171.77 |

| Others | 2,167.93 | 2,412.63 | 2,685.88 |

Orthodontics Market Revenue (USD Million) By Age Group, 2022-2024

| End User | 2022 | 2023 | 2024 |

| Teen | 4,199.89 | 4,691.82 | 5,243.67 |

| Adults | 12,700.91 | 14,245.37 | 15,984.61 |

Access our full report to explore high-resolution charts, regional dashboards, and technology adoption trends shaping the next decade of orthodontics

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1493

Become a valued research partner with us - https://www.precedenceresearch.com/schedule-meeting

Orthodontics Market Overview & Potential:

What is Orthodontics?

Orthodontics is a specialized dentistry branch that focuses on the prevention, correction, diagnosis, and management of misaligned jaws & teeth. It addresses problems like overbites, crossbites, crooked teeth, and underbites. The orthodontic treatments consist of retainers, traditional braces, and clear aligners. These treatment helps in the improvement of chewing, oral care, and speaking. It minimizes the risk of gum disease and tooth decay.

Major Orthodontics Software Used Across the Globe:

| Software | Features |

| OrthoSelect |

|

| Ortho2 Edge |

|

| Dolphin Imaging |

|

| Ormco Insignia |

|

| Cloud 9 Ortho |

|

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

“For investors and medtech innovators, the orthodontics market presents scalable opportunities across product development, SaaS-based practice tools, and regional expansions — particularly in Asia-Pacific and Latin America.”

Orthodontics Market Opportunity:

What are Technological Advancements in Orthodontics?

Technological Advancements Surge Demand for Orthodontics

The growing technological advancements in orthodontics help in the development of comfortable, precise, and efficient treatment. The advancements like digital imaging, clear aligners, 3D printing, self-ligating braces, Temporary Anchoring Devices, and others help in the market growth. The increasing availability of intraoral scanners, 3D dental imaging, and digital treatment planning helps the market growth. The development of Invisalign & similar systems and customized aligners using CAD/CAM technology expands the market.

The focus on reducing treatment time, minimizing friction, and enhancing comfort increases the development of orthodontic treatments. The advancements like robotic wire bending, personalised appliances, accelerated orthodontics, and remote monitoring increase precision and efficiency. The growing technological advancements create an opportunity for the orthodontics market.

Orthodontics Market Challenges and Limitations:

What is the Limitation for the Orthodontics Market?

High Treatment Cost Shuts Down Expansion of the Orthodontics Market

Despite several benefits of orthodontics, the high treatment cost restricts the market growth. Factors like treatment complexity, high-cost materials, long duration of treatment, energy-intensive technology, and specialized expertise are responsible for high treatment costs. The specialized expertise, like extensive training, in-depth skills, and knowledge, leads to higher costs.

The complex treatments like jaw surgery, misalignments, and other dental issues increase the cost. The need for lingual, metal, & ceramic materials aligners, braces, and many more, increases the treatment costs. The advancements like 3D printing and digital imaging, lead to higher treatment costs. The regular check-ups and adjustments require a higher initial cost. The high treatment cost hampers the growth of the orthodontics market.

Also Read@ Dental Braces Market Size, Share and Trends 2025 to 2034

Scope of Orthodontics Market Report:

| Report Attributes | Statistics |

| Market Size in 2024 | USD 21.23 Billion |

| Market Size in 2025 | USD 23.81 Billion |

| Market Size in 2030 | USD 42.52 Billion |

| Market Size in 2032 | USD 53.79 Billion |

| Market Size by 2034 | USD 65.13 Billion |

| Growth Rate (2025-2034) | CAGR of 11.9% |

| Base Year | 2024 |

| Forecast Years | 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Product, Age Group, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Become a valued research partner with us -https://www.precedenceresearch.com/schedule-meeting

Orthodontics Market Key Regional Analysis:

How North America Dominated the Orthodontics Market?

North America dominated the orthodontics market in 2024. The growing number of misaligned teeth and orthodontic issues in the region increases the demand for orthodontic treatments. The well-established healthcare infrastructure, like specialized orthodontics clinics and dental professionals, helps the market growth.

The growing awareness about the benefits of orthodontic treatment and technological advancements like AI-driven treatment planning & 3D printing help the market growth. The increasing demand for dental aesthetics and the availability of dental insurance drive the market growth.

Also Read@ U.S. Dental Services Market Size, Share, and Trends 2025 to 2034

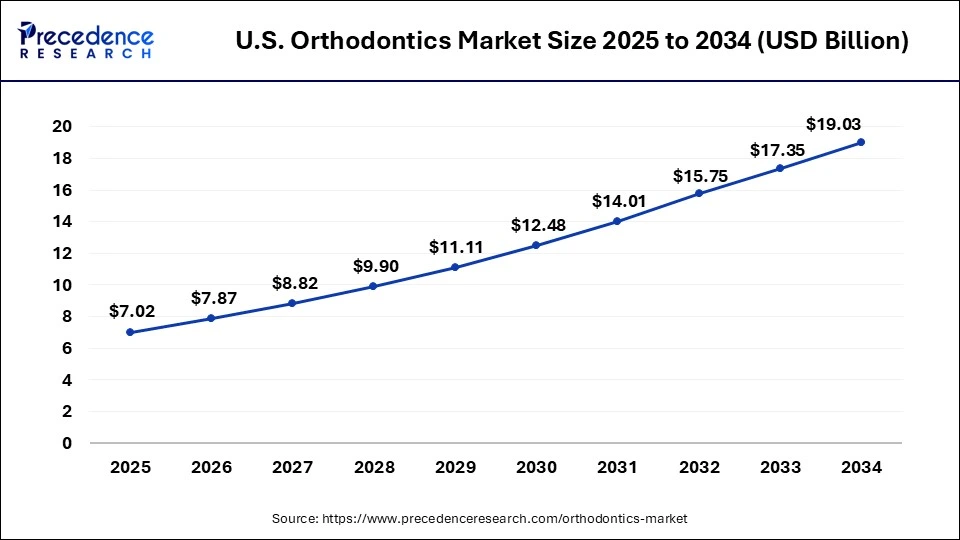

U.S. Orthodontics Market Size and Forecast 2025 to 2034

According to Precedence Research, the U.S. orthodontics market size is valued at USD 7.02 billion in 2025 and is expected to hit over USD 19.03 billion by 2034, expanding at a solid CAGR of 11.8% from 2025 to 2034.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1493

U.S. Orthodontics Market Trends:

With a highly developed dental infrastructure and wide insurance coverage, the U.S. sees consistent demand for both adolescent and adult orthodontic treatments. One of the most notable growth drivers is the shift from traditional metal braces to clear aligners like Invisalign, which offer more discreet, comfortable, and removable alternatives.

The market is also benefiting from 3D printing, digital scanning, and AI-assisted treatment planning, which reduce chair time, improve treatment accuracy, and make orthodontic care more accessible. Many dental practices are offering in-house aligner manufacturing, streamlining delivery and reducing cost for patients. Moreover, direct-to-consumer aligner brands are rising in popularity, appealing to cost-conscious adults seeking mild corrections without regular in-office visits.

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

Asia Pacific Orthodontics Market Trends:

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The increasing prevalence of malocclusion fuels demand for orthodontic treatments. The increasing affordability of corrective and cosmetic dental procedures helps the market growth. The increasing awareness of dental aesthetics fuels demand for orthodontic treatments. The growing demand for clear aligners and technological advancements like intraoral scanners, 3D imaging, & CAD/CAM systems supports the overall growth of the market.

India Orthodontics Market Trends:

India is witnessing a boom in clear aligners, especially among urban professionals. While global brands are present, local startups are increasingly offering homegrown, cost-effective aligner solutions backed by digital impression technology and remote consultations. This price disruption is making orthodontics more affordable across a wider income range.

Furthermore, dental colleges and private institutions are increasing their focus on orthodontic specialization, which is gradually improving the dentist-to-patient ratio and enabling wider service availability. Corporate dental chains and tele-orthodontic models are gaining traction, particularly in Tier 2 and Tier 3 cities where dental access was previously limited.

➤ Get the Full Report @ https://www.precedenceresearch.com/orthodontics-market

Orthodontics Market Segmentations Analysis:

| Segment | Sub‑segments |

| Product | Supplies and Instruments |

| End User | Hospitals, Dental Clinics and Others |

| Age Group | Adults and Children/Teens |

Product Analysis

Why Supplies Segment Dominate the Orthodontics Market?

The supplies segment dominated the orthodontics market in 2024, owing to the growing prevalence of dental problems due to factors like genetic predisposition, improper eating habits, and poor oral hygiene that increases demand for supplies. The consumer focuses on improving overall oral health and improving smiles fuels demand for supplies like aligners & braces.

Advancements like clear aligners, customized braces, and self-ligating brackets help the market growth. The growing demand for orthodontic treatments in adults, children, and teenagers increases demand for supplies. The presence of major players like Envista Holdings Corporation, American Orthodontics, Solventum Corporation, Rocky Mountain Orthodontics, and Align Technology, Inc. drives the market growth.

The instruments segment is expected to be the fastest-growing in the market during the forecast period. The growing demand for misaligned teeth orthodontic treatments increases the demand for instruments. The focus on improving the appearance of smiles increases adoption of instruments. The growing development of comfortable and efficient orthodontic instruments helps the market growth. The growing development of specialized instruments, like aligning instruments, cutters, pilers, and forceps, supports the overall growth of the market.

End User Analysis

How Dental Clinics Segment Held the Largest Share in the Orthodontics Market?

The dental clinics segment held the largest revenue share in the orthodontics market in 2024 due to the increasing awareness of cosmetic dentistry fuels the adoption of dental clinics. The focus on minimally invasive procedures fuels demand for dental clinics. The easy accessibility and shorter waiting times for procedures & appointments help the market growth. The increasing demand for tailored treatment plans and specialized care increases the adoption of dental clinics. The growing prevalence of misaligned jaws & teeth and growing orthodontic treatments in adults drives the market.

The hospitals segment is experiencing the fastest growth in the market during the forecast period. The increasing surgical procedures like craniofacial reconstruction and jaw alignment require hospitals. The increasing advancements in diagnostics technologies & tools like digital imaging systems and CBCT help the market growth. The increasing demand for coordination between oral surgeons, relevant specialists, orthodontists, and periodontists requires a hospital. The availability of advanced treatments like 3D printing and robotic surgery supports the market growth.

Also Read@ Medical Digital Imaging System Market Size, Share and Trends 2025 to 2034

Age Group Analysis

How Did the Adults Segment Dominate the Orthodontics Market in 2024?

The adult segment dominated the orthodontics market in 2024, owing to the consumer emphasis over well-aligned smile increases demand for orthodontic treatments. The increasing awareness about oral hygiene in adults helps the market growth. The growing demand for orthodontic treatments to improve chewing & speaking, correct bite issues, and alleviate jaw pain in adults helps the market growth. The growing popularity of invisible aligners and lingual & ceramic braces in adults drives the market growth.

The children's segment is the fastest-growing in the market during the forecast period. The increasing parents' awareness of children’s dental health increases demand for orthodontic treatments. The growing prevalence of malocclusion in children helps the market growth. The increasing popularity of aesthetic treatments in children and the focus on early treatment support the market growth.

Related Topics You May Find Useful:

➢ Digital Dentistry Market: The global digital dentistry market size accounted at USD 6 billion in 2024 and is expected to be worth around USD 19.66 billion by 2034, at a CAGR of 12.60% from 2025 to 2034.

➢ Clear Aligners Market: The global clear aligners market size was estimated at USD 6.51 billion in 2024 and is anticipated to reach around USD 94.84 billion by 2034, expanding at a CAGR of 30.72% from 2025 to 2034.

➢ Prosthetics and Orthotics Market: The global prosthetics and orthotics market size accounted for USD 8.79 billion in 2024 and is predicted to reach around USD 13.94 billion by 2034, growing at a CAGR of 4.72% from 2025 to 2034.

➢ Dental Biomaterials Market: The global dental biomaterials market size was estimated at USD 9.62 billion in 2024 and is predicted to increase from USD 10.26 billion in 2025 to approximately USD 18.4 billion by 2034, expanding at a CAGR of 6.7% from 2025 to 2034.

➢ Dental Software Market: The global dental software market size was estimated at USD 1.76 billion in 2024 and is anticipated to reach around USD 4.25 billion by 2034, expanding at a CAGR of 9.22% from 2025 to 2034.

➢ Orthodontic Supplies Market: The global orthodontic supplies market size accounted for USD 14.41 billion in 2024 and is predicted to increase from USD 17.65 billion in 2025 to approximately USD 104.01 billion by 2034, expanding at a CAGR of 21.85% from 2025 to 2034.

➢ Invisible Orthodontics Market: The global invisible orthodontics market size accounted for USD 7.94 billion in 2024 and is predicted to reach around USD 90.27 billion by 2034, growing at a CAGR of 27.52% from 2024 to 2034.

➢ Dental Services Market: The global dental services market size accounted for USD 475.83 billion in 2024 and is expected to exceed around USD 763.74 billion by 2034, growing at a CAGR of 4.85% from 2025 to 2034.

Orthodontics Market Top Companies

- 3M Company

- Align Technology, Inc.

- American Orthodontics

- Danaher Corporation

- Dentaurum GmbH & Co. KG

- DENTSPLY International, Inc.

- G&H Orthodontics, Inc.

- Henry Schein, Inc.

- Rocky Mountain Orthodontics, Inc.

- TP Orthodontics, Inc.

Competitive Landscape Insights:

-

Align Technology leads the global clear aligner market, consistently innovating in AI-powered treatment planning and personalized orthodontic solutions.

- 3M and DENTSPLY continue to dominate the orthodontic hardware segment through extensive R&D in advanced bracket systems and product durability.

Recent Developments:

The orthodontics landscape is being reshaped by faster, more personalized, and tech-driven product offerings. Here are some recent innovations that signal where the market is heading:

- In September 2024, ULAB launched thermoforming material, Reva, for clear aligners. The materials improve patient comfort and force retention. It is available for in-office use and is a thinner thermoforming material. (Source: https://orthodonticproductsonline.com)

- In June 2024, LM-Dental launched My LM-Activator appliance for early orthodontic treatment. The appliance is suitable for overbite, anterior open bite, distal bite, excess overjet, deep bite, anterior crowding, and anterior crossbite. The appliance supports healthy jaw growth and corrects malocclusions. (Source: https://orthodonticproductsonline.com)

- In August 2023, Ormco launched updated Spark Clear aligners. The features of aligners include expanded real-time approval, aligner trimeline, and TruRoot cone-beam computed tomography collision alert system. (Source: https://www.drbicuspid.com)

- In October 2024, Trycare launched a new orthodontic range. The product range includes a fabulous range of attachments, an extensive range of IPR, and accessories for patient care. (Source: https://www.nature.com)

Case Study: Digital Innovation in Orthodontic Care

How a U.S.-Based Dental Chain Reduced Treatment Time by 30% Using AI-Enabled Aligners

SmileCraft Dental Group, a multi-location dental chain in the U.S., integrated AI-based treatment planning and in-house 3D printing into its orthodontic services in early 2023. By partnering with Align Technology and using iTero scanners combined with Invisalign’s ClinCheck software, the clinic:

- Reduced average treatment time from 18 months to 12.5 months

- Increased adult patient conversions by 40% in one year

- Lowered aligner manufacturing costs by 22% through on-site 3D printing

Moreover, digital case simulations improved patient confidence and upfront acceptance rates. The clinic now serves as a model for scalable tech-driven orthodontic workflows.

“Implementing AI-based aligner systems gave us efficiency and personalization. Our patients value speed and aesthetics — and we delivered both,” said Dr. Lisa Monroe, Lead Orthodontist at SmileCraft.

Orthodontics Market Segments Covered in the Report

By Product

- Instruments

- Supplies

- Fixed

- Archwires

- Brackets

- Bands and Buccal Tubes

- Others

- Removable

- Retainers

- Aligners

- Others

- Fixed

By End User

- Hospitals

- Dental Clinics

- Others

By Age Group

- Adults

- Children

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1493

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.